Navigating US Tariffs: Threats and Opportunities for Innovation Leaders

Future-proof your business by acquiring knowledge about the technologies across your value chain and forging new partnerships.

Welcome to our first post of Research Insights by Roundtable!

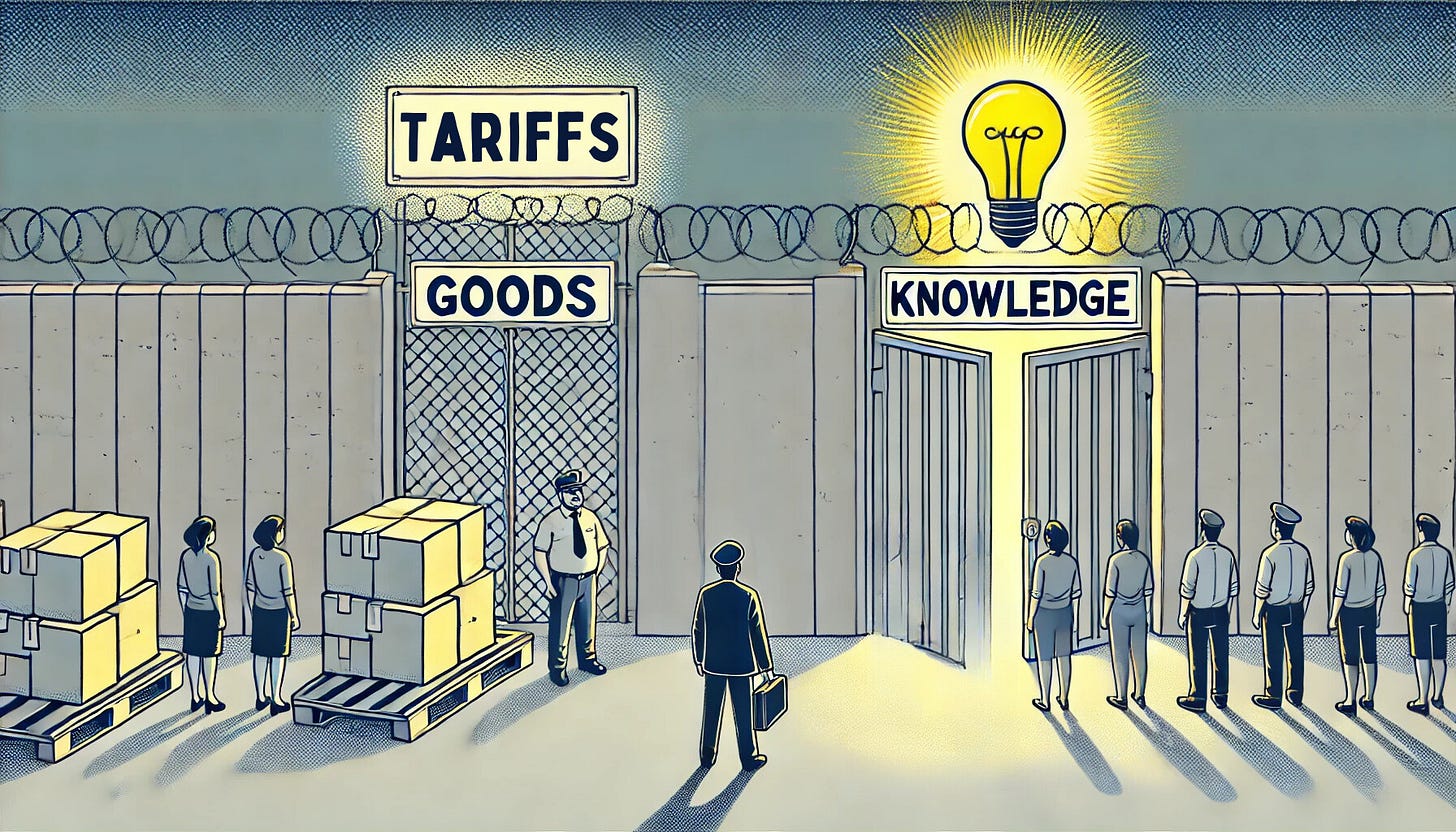

We’re kicking off with a topic that’s top-of-mind for many businesses: the impact of proposed US tariffs from the perspective of research and development (R&D). In this article, I argue that a focus on importing knowledge rather than goods can be an effective way for innovation leaders to protect their business from the risks of tariffs.

As the saying goes…

Give a man a fish and you feed him for a day,

Put a tariff on fish, and he’ll teach himself to fish.

What’s New

Soon-to-be President Trump has proposed sweeping tariffs for his second term in office, ranging from a universal 10% tariff to rates of up to 25% for countries like Canada and Mexico, and over 60% for China [1],[2]. During his first term, Trump imposed tariffs on a wide range of imported goods, including steel, aluminum, solar panels, and many Chinese products. The objectives of these tariffs appear to be twofold: protect local production in the US and use tariffs as leverage in broader negotiations.

For businesses, the risks of these proposals should be taken seriously. Trump has significant legal authority to impose tariffs while negotiating trade agreements, and even broader across-the-board tariffs could become a reality with support from a Republican-controlled Congress [1].

Why Does It Matter?

Tariffs have implications for any company engaged in global trade. Whether you’re a startup importing specialized equipment to develop your product or a multinational exporting materials to the US, these trade barriers can disrupt your sourcing strategies, partnerships, and investments.

For innovation leaders, tariffs can be a threat to your R&D operations. But they can also present opportunities to help your company navigate broader mitigation strategies. Here’s a breakdown of the potential impacts and later on we’ll list a few ways you can take action.

For US Companies:

Near-Shoring Supply Chains: Tariffs may accelerate the trend of near-shoring supply chains that began during the pandemic [3]. In some cases, it might make sense to bring parts of your upstream supply chain in-house, which will likely require expanding your R&D efforts to support those new operations.

Sourcing Disruptions: Universal tariffs on imported goods could increase costs for critical materials, components, or specialized equipment used in R&D. For instance, if you’re developing drone technologies, you likely source from Chinese companies like DJI and Yuneec, which dominate 75% of the commercial drone market. Tariffs may force you to find alternative suppliers or partner with local technology providers [4].

Scrutiny of Foreign Investments. Re-evaluate your strategic foreign investments, particularly of startups in sensitive sectors like AI and biotechnology, for two reasons: 1) tariffs could alter the deal economics or disrupt their ability to supply goods, and 2) increased regulatory concern on cross-border transactions, could complicate joint operations. Export controls, though distinct from tariffs, often accompany heightened trade barriers.

For Foreign Companies:

Margin Pressure. Many companies absorb tariff costs to remain competitive, but this can erode profitability. To counteract this, businesses may invest capital in technologies to improve efficiency and reduce operational costs.

Local Production: Establishing production facilities in the US can help foreign firms bypass trade barriers. This approach requires identifying new technology suppliers, distributors, and local collaborators.

Re-Evaluation of Investments in US Startups. Economic and regulatory uncertainty may push foreign companies toward self-sufficiency and to form new alliances out of necessity [3]. In fact, a study has shown that import tariffs of the host country tend to have a negative effect on FDI, suggesting that a host country’s general openness to trade may be more important to foreign direct investors than receipt of bilateral preferential market access [5].

What Can You Do About It?

For innovation leaders, the outlook may seem daunting: goods will cost more, supply chains will face disruptions, and technology investments carry greater risk.

But one simple strategy can help mitigate these threats: acquire knowledge across your value chain. Whether you’re considering changing technology suppliers, bringing the manufacturing of a key input in-house, or establishing local production, it’s critical to understand the technological inputs to your products, their sources, and the improvements that innovation could unlock.

While this may seem like an obvious task, it’s a skill many corporations need to rebuild. In the era of globalization and low interest rates, companies often relied on acquiring capabilities through global suppliers or investing in startups. No longer. Innovation leaders should assess their team’s skills, equipment, and expertise, identify gaps across their entire value chain, and determine whether to fill those gaps through partnerships or collaborations.

Here’s are a few ways to get started:

Collaborate with Universities. Sponsoring projects with universities or hiring professors as consultants can be efficient ways to transfer knowledge and expertise in cutting-edge technological areas. Also, they can often connect you to suppliers, manufacturers and customers within their market. And as a service, contracted university research is generally not subject to tariffs.

Form New Partnerships with US Technology Providers. Small businesses specializing in contract research, product development, or small-batch manufacturing can be invaluable partners for learning how to adapt your product to the US market or scale operations locally.

Establish a Local R&D Center. While costly, opening an innovation center in the US can be a powerful strategy for larger multinational companies. An example is ZEISS, the leading provider of optics and optoelectronics technology from Germany, who recently opened an innovation center in the San Francisco Bay Area to form new partnerships and open up US market opportunities [6].

Any business can invest in knowledge-building; it isn’t just for multinationals with large budgets. For instance, I recently spoke with a European startup pursuing a research collaboration with a US university. This partnership would help them achieve two key goals: 1) develop new application areas where they lacked in-house expertise, and 2) start to build connections with talent, suppliers, and potential customers in the US market.

Conclusion

While much about Trump’s proposed tariffs remains uncertain, it’s clear that businesses must be ready to adapt to shifting trade and regulatory dynamics. For innovation leaders, the best way to prepare now is by emphasizing investments in knowledge. By collaborating with universities, diversifying technology sources, and building local expertise, you can equip your business to navigate challenges and make informed, strategic decisions for the future.

Looking to form new R&D collaborations? Reach out to us at Roundtable—we’d love to help!

Thanks for reading. If you have any topics you’d like us to cover, leave a comment or reply to let us know!

[1] Trump's Agenda: Tariffs - FactCheck.org

[2] Trump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1 | CNN Politics

[3] Investment Strategy: Trump 2.0 Tariffs’ Corporate Impact | PineBridge Investments

[4] Commercial Drone Market Size, Share & Growth Report - 2032

[5] Foreign Direct Investment: Impact of Trade Costs to Investment Flows

[6] ZEISS opens high-tech center to leverage new digital and other market opportunities in North America